By Sofia Guerreiro, Ricardo Ribeiro Pereira, Iker Perez, Jacopo Bono

Detecting financial fraud is like finding a moving needle in a shifting haystack. Fraud accounts for a tiny fraction of financial transactions, often less than 0.1%. At the same time, fraudsters are constantly adapting their tactics to evade detection. And this happens within a live and dynamic environment, where financial behaviors and technologies are changing over time. In short, this is an exceptionally difficult problem for financial institutions.

With the rise of digital banking and new technologies like GenAI, this problem is becoming even more challenging. In fact, fraud schemes are spreading faster, growing more sophisticated, and becoming increasingly coordinated across geographies. Meanwhile, many financial institutions still rely on detection systems that are either too rigid (e.g., relying on handcrafted rules) or too narrow (e.g., dependent on custom AI models), and neither option can keep up with the pace of change.

At Feedzai, we’ve developed a new approach. In this blog post, we introduce Feedzai TrustScore, part of the Feedzai IQ™ solution. This is a state-of-the-art AI solution that combines the aggregated knowledge from our network of $8.02T yearly processed events to detect threats earlier, adapt continuously, and safeguard financial systems with speed and precision.

Traditional Fraud Detection: Catching a Moving Target With a Fixed Net

Every year, millions of people fall victim to financial fraud or scams, with a recent report revealing an average loss of over $2,000 per victim. To protect their customers, banks and other financial institutions have made great efforts towards detecting these suspicious transactions, sometimes temporarily blocking them, conducting internal reviews, and contacting the account owner to validate the activity.

However, this is an inherently adversarial task, as malicious actors adapt to whatever detection system the banks have in place. These players are always searching for “cracks in the system” or leveraging new tools such as GenAI to develop more sophisticated attacks.

While fraudsters are quick to incorporate new technologies in their attacks, most traditional fraud detection systems still rely on either rule-based approaches or institution-specific custom AI models. Rule-based systems typically consist of a set of manually defined conditions that describe known fraud patterns. Custom AI models, on the other hand, are trained on historical data from that specific institution only.

While these approaches can be useful, both present several shortcomings:

- Slow to deploy: Both rule-based systems and custom AI models require substantial time and effort to design, tune, and validate before they can be deployed. This often involves months of work by analysts, data scientists, and domain experts.

- High maintenance: These systems demand constant manual updates and oversight to remain effective, especially as fraudsters adapt their tactics. This creates a continuous operational burden on fraud teams.

- Reactive and narrow in scope: Whether rule-based or AI-driven, conventional detection systems are developed using knowledge from a single institution, offering a narrow and siloed view of fraud. This makes them inherently reactive (learning only after fraud has occurred) and blind to emerging fraud patterns or schemes that haven’t yet appeared in their own environment.

These constraints are especially problematic given the nature of modern financial crime: fraudsters operate across borders and institutions, sharing techniques and exploiting gaps in visibility. It raises the question: if attackers are collaborating, why aren’t defenders doing the same?

Introducing: Feedzai TrustScore

Feedzai TrustScore, part of Feedzai IQ™, addresses these limitations by relying on pre-trained AI experts, which encode the collective knowledge from Feedzai’s broad network of partners. Unlike traditional detection systems, this solution is ready-to-use, doesn’t require months of historical data collection, has built-in processes for continuous refreshing, and can leverage shared intelligence to prevent fraud attacks sooner, all while guaranteeing strict data privacy standards.

How does it work?

Feedzai TrustScore is built on a Mixture of Experts (MoE) architecture, a modular approach where multiple expert models are developed on different environments or fraud scenarios, and then are combined to produce the final risk decision.

A real-world analogy to this would be to diagnose a disease by consulting a panel of medical specialists (e.g., a cardiologist, a neurologist, a nutritionist, and a general practitioner) rather than choosing a single doctor. Each specialist would conduct their analysis from their specialized field, and then they would all discuss their findings to provide the most accurate diagnosis and treatment plan.

In the same way, Feedzai TrustScore aggregates the fraud knowledge from across the Feedzai community using a federated learning framework. Each expert model is developed to become a “specialist” in a specific geography and use case (e.g., banking, payment processing, or anti-money laundering). Then, to deploy the solution, a mixture of experts (the “panel of specialists”) is assembled by combining a set of relevant pre-trained models, which is immediately available to start making predictions.

One important remark is that, throughout the entire process, data never leaves the client’s secure environment. Only a high-level encoding of the fraud patterns, represented in the form of machine learning models, is shared across institutions. This ensures full regulatory compliance and protects our customers’ sensitive data.

What are the benefits?

- Zero-day Solution: Feedzai TrustScore is a ready-to-use fraud detection tool. New clients benefit from pre-learned fraud patterns, eliminating the time needed for data collection, rules creation, or model training.

- Continuous Refreshing: Feedzai TrustScore is a dynamic solution, actively maintained and updated in order to continuously integrate both newly found patterns of fraud and the latest machine learning techniques.

- Improved fraud detection: Feedzai TrustScore significantly outperforms traditional out-of-the-box rule systems by combining the power of AI with the aggregate fraud knowledge of Feedzai’s network.

- Responsible by design: Feedzai TrustScore is developed with responsibility at its core, guided by Feedzai’s TRUST Framework. Besides providing strict privacy guarantees by design, this approach ensures transparency, fairness, and auditability, making it compliant with the most demanding regulatory environments.

Technical Considerations

Building a fraud detection system that depends on the collective intelligence of a large network of financial institutions comes with several technical and operational challenges. We will go through some of them:

Data Standardization

To develop a unified AI solution, applicable to multiple institutions, the format and the meaning of the data must be standardized, such that the patterns that the experts learned can be seamlessly integrated into new financial institutions. This process includes several procedures, for example:

- Schema Alignment: Financial data is usually tabular, with rows as events and columns as information dimensions. We define a standard schema to unify table structure across institutions, allowing each to populate it with available data. The schema supports incomplete tables, so not all columns need to be filled.

- Categorical Consistency: Different institutions may use different encodings to represent the same categorical information, such as “merchant type.” We use mapping and harmonization techniques to ensure the representations of categorical features are consistent across environments.

- Currency Normalization: The difference between normal and abnormal spending behavior depends on the context into which it is inserted. In order to standardize some of these differences, we use currency conversions, cost-of-living adjustments, and percentile-based features.

- Time Zones and Derived Features: Transaction time is a critical signal, and with Feedzai’s global reach, this means combining insights from all across the world simultaneously. As such, we normalize across time zones and engineer derived features (e.g., daytime vs. nighttime spending) that remain meaningful across institutions.

Expert Calibration

In a MoE solution such as Feedzai TrustScore, all experts should effectively contribute to the final risk score. But this is a delicate balance, since each expert is trained independently, without context from the other experts and their environments. We use calibration techniques to ensure that experts yield scores that represent fraud risk homogeneously.

Monitoring and Refreshing

Feedzai TrustScore is monitored and tuned regularly at both the expert level and the MoE aggregation level. This ensures robustness and allows us to detect model drift early. Moreover, individual expert models can be added, removed, or updated whenever we detect performance drops or want to integrate the latest fraud patterns in the Feedzai TrustScore system.

Stable and Interpretable Risk Score

As fraud patterns evolve and expert models are updated, the risk score must remain consistent and reliable over time. To ensure this, we apply techniques that keep the score distribution stable, even as the underlying system changes. This facilitates the integration with downstream systems, and ensures that each score consistently reflects the same level of transaction risk, making it more interpretable.

Personalization and Augmentation

Feedzai TrustScore can be fine-tuned and optimized for individual financial institutions as soon as enough of their own data has been collected, which further improves its predictive performance. Furthermore, this risk score can be seamlessly combined with other solutions, such as rules or custom AI models, to augment their performance. This is an example of how Feedzai TrustScore can provide value not only when activating a new customer, but in a long-term setting.

Conclusions

In this blog post, we introduced Feedzai TrustScore, an AI-powered fraud risk score designed to detect fraud as a zero-day solution, without relying on historical data or complex model setups.

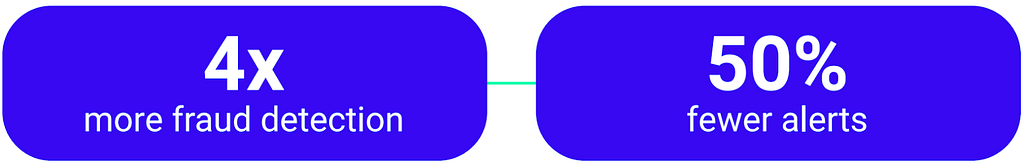

Feedzai TrustScore combines insights from a global community of financial institutions using a Mixture of Experts architecture and federated learning principles. This enables the detection of emerging fraud patterns that may be invisible to any single institution, while maintaining strict data privacy and compliance standards. Real-world results show a boost in fraud detection, a reduction in false alerts, and a faster time to market, proving that collective intelligence can drive real business value.

Feedzai TrustScore is not just an incremental improvement. It represents a completely different approach to tackling the problem of fraud detection, allowing our customers to stay ahead of the criminals, to better protect their clients.

If you would like to know more about Feedzai TrustScore and other Feedzai IQ™ initiatives, feel free to reach out to the Feedzai Product team: product@feedzai.com.

If you are interested in exciting AI projects to combat financial crime, get in touch with the Feedzai Research team: research@feedzai.com.

Feedzai TrustScore: Enabling Network Intelligence to Fight Financial Crime was originally published in Feedzai Techblog on Medium, where people are continuing the conversation by highlighting and responding to this story.